A financial asset's return for the year to Date is the sum of its gains (or losses) from the beginning trading day within the current year. Year-to-date (YTD) return is a popular metric for comparing a company's profitability or monitoring investment performance. To determine the total YTD:

- Take the value at the beginning of the year and subtract that from the balance at the end of the calendar year.

- Split the output by the deal at the beginning of the year.

- Multiply by 100 to get the average rate of return.

How to Calculate the Year-to-Date (YTD) Return on My Portfolio

What's YTD?

As a time measurement, "year to date" (YTD) covers everything from the commencement of the preceding calendar year already fiscal year to the present. Year-to-date (YTD) data help spot patterns and compare corporate performance. The acronym is frequently used to modify terms like investment returns, profit, and net pay.

What Is The (YTD) Return?

The return on an investment calculated from the first trading week of the current cycle year is known as the return for the year-to-date (or YTD). When evaluating a portfolio's success or comparing several stocks' past performances, traders and analysts frequently resort to YTD statistics.

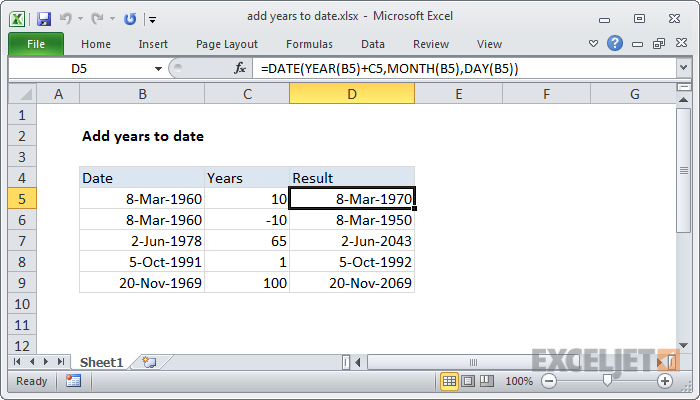

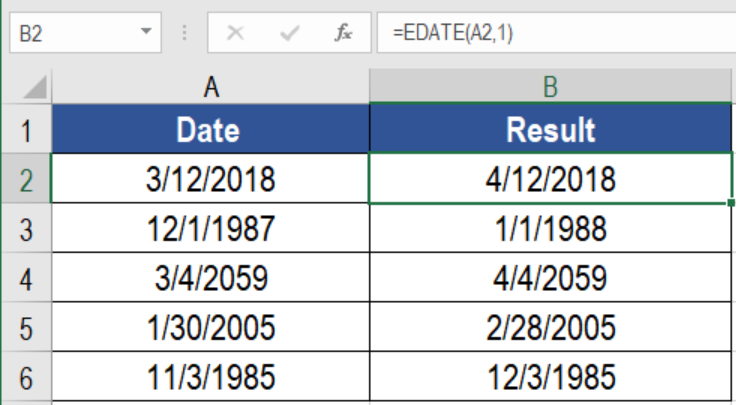

How to Calculate the Year-To-Date Return

Add this same price of a stock to the total dividends paid out so far this year to determine the return for the year. Once you get that number, divide it by the stock's closing price on January 1 to get an annualized price. Here, we can see how to arrive at $15.50 by adding $1 to $14.50. Get 1.48 by dividing $15.50 by $10.50. Take the final number and subtract 1. In this case, the outcome would be 0.48 since 1.48 would be reduced by 1. Stock's YTD return can be expressed as a percentage by multiplying this figure by 100. A 48 percent return year-to-date can be calculated by multiplying the current value by 100, or 0.48.

Year-To-Date Revenue

Earnings year-to-date is the total sum of money a person has made since the beginning of the year. In addition to income tax and Medicare/Social Security withholdings, this sum is often included on a worker's pay stub. Earnings for the year to Date (YTD) can also refer to the total amount of money made by a firm or freelancer from the start of the year. It's the net profit after deducting all the costs. Business owners use profits for the year to plan for the rest of the year and calculate quarterly tax payments.

Net Pay for the Year

To calculate an employee's net pay, subtract the total amount of taxes withheld from their gross salary. After federal, state, and local taxes are deducted from an employee's gross pay, the remaining amount is known as take-home pay. Year-to-date net pay, or YTD net pay, is the gross amount of salary since one January of either the present year, less any taxes deducted.

Month to Date

The timeframe from the beginning of the corresponding month to the present is known as the month to Date (MTD). In the case where today is May 19, MTD would refer to the period beginning on May 1 and ending on May 18. Since it is not yet the end of the work day, the current Date is usually omitted from MTD calculations. Uses for this metric are analogous to those for YTD metrics. Income, organization earnings, and capital appreciation for the month thus far are analyzed using MTD data by their respective owners, investors, and individuals.

Conclusion

Year to Date is a financial word that indicates the period between the start of the fiscal year and the present Date. Companies will utilize the YTD concept for numerous reporting objectives, including financial reporting, predictive modeling, data analysis, and monitoring investment returns. To compute YTD, simply subtract the value at the commencement of the calendar year or financial year from the most recent value. Then, divide the total by the deal at the start of the fiscal year or the calendar year to get an annual rate. The percentage is then obtained by multiplying the final figure by 100.

watch next